2024 Form 1040 Schedule 7 5 1 – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . Every dollar you win from gambling should be reported to the IRS, otherwise you could be fined or even go to jail. .

2024 Form 1040 Schedule 7 5 1

Source : www.irs.govWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Form 1040 ES

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS unveils new tax brackets, standard deduction for 2024 tax year

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govNew Hampshire tax filers have a new filing option, directly from

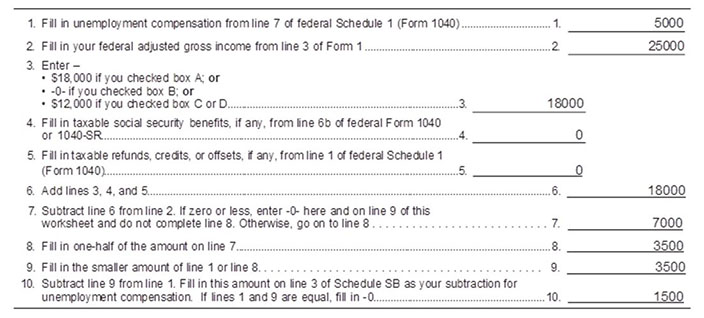

Source : newhampshirebulletin.comDOR Unemployment Compensation

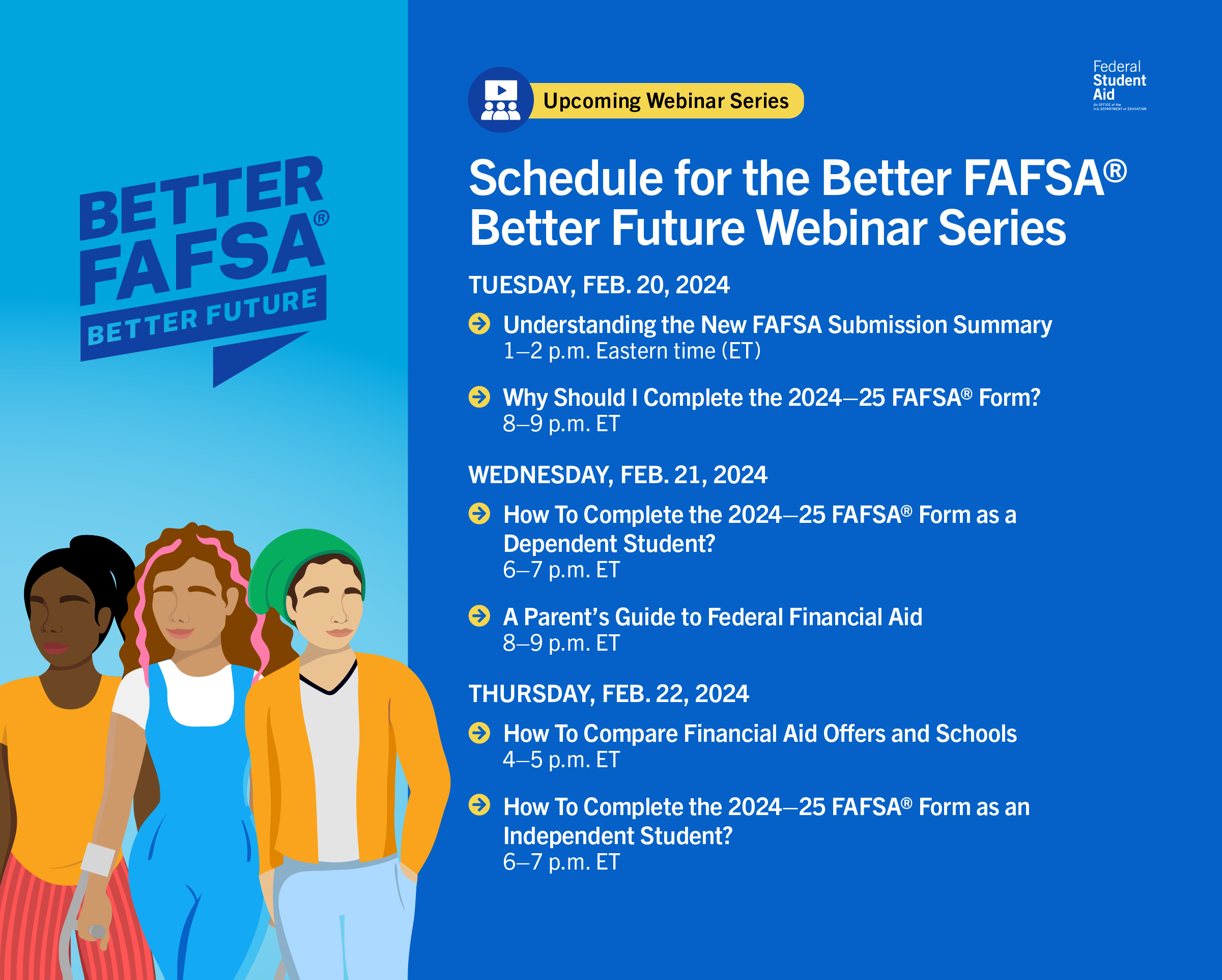

Source : www.revenue.wi.govFederal Student Aid (@FAFSA) / X

Source : twitter.com2024 Form 1040 Schedule 7 5 1 1040 (2023) | Internal Revenue Service: Form 1040, Schedule C, Line 1 Report all money you collected in your business on Line 1 of Schedule C. This amount should include all commercial sales taxes you collected. You do not need to . But if you’ve got more things going on in your life, you may also need to get ahold of additional forms, also called schedules, to submit alongside your Form 1040. Schedule A, for example .

]]>